Finding the right credit card that works for your budget and your needs is crucial. Most people are looking for a card that will help them manage their money, provide a secure way to pay, and help them build their credit.

A good card can help you with your everyday expenses and be easy to manage. That is why there are so many options available. Each will have unique benefits and features, and the rates and fees will vary, as well.

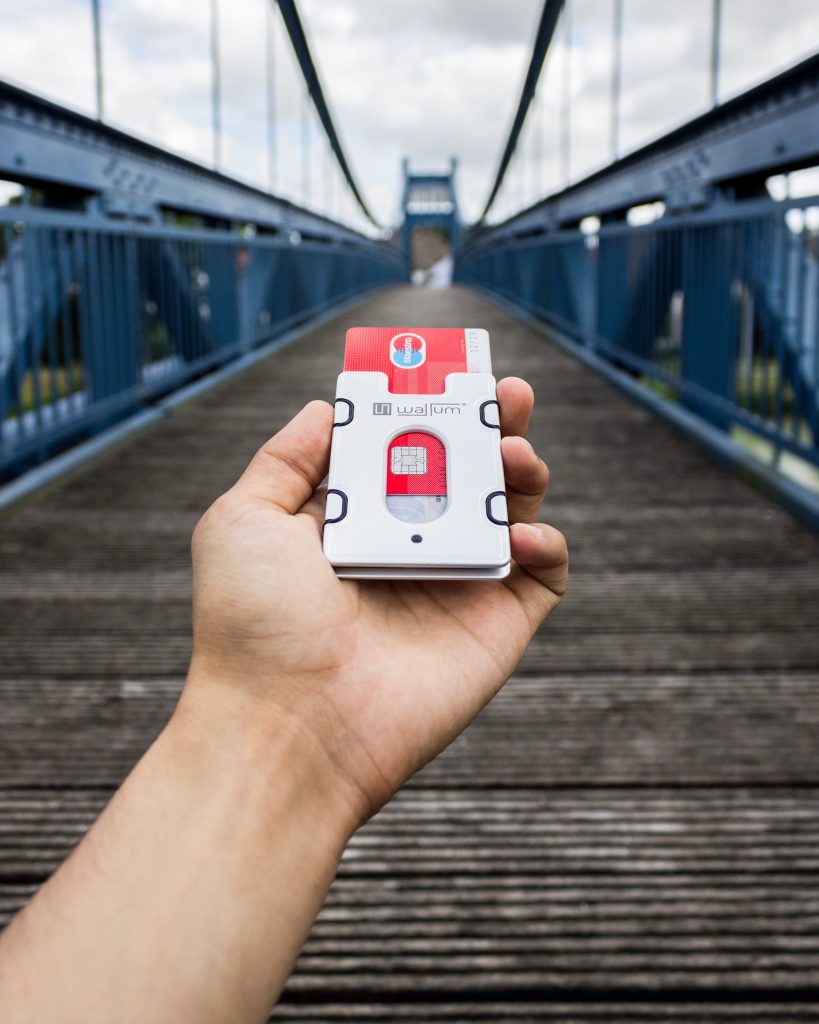

One of these cards is the Lloyd’s Bank Low Rate Mastercard. It is competitive with its peers, and in this article, we will look at everything you need to know about it, including how to apply for one.

Lloyd’s Bank Mastercard Benefits & Features

This card comes with several features and benefits designed to make the management and use of the card easier. With this card, you will have access to the management of this card through an online site, as well as a downloadable app.

There is also fraud protection included with the card, and the cardholder will not be liable for any purchase deemed fraudulent. If the user notices anything suspicious or loses the card, all they have to do is alert the bank. The bank will begin investigating the charge or sending the cardholder a new card.

The card also allows for easy payments, and the cardholder can choose to pay with anything, including a debit card. This card comes with contactless payment, and the information for the card can be added to a mobile phone for even easier use.

Fees & Rates

This card comes with no annual or monthly fees. In regards to balance transfers, the rate is 9.94%, along with a 3% transfer fee. When a cardholder makes a purchase or takes a cash advancement, that transaction will see a 9.94% rate, as well. For the first 56 days, the card affords its user an interest-free period. You can obtain one extra card, and there is no minimum or maximum limit.

This card requires a minimum monthly payment of 1% or £5, whatever is the greater amount. Alternatively, you can pay the total interest, default fees, plus 1% of the balance. Along with this payment expectation, there are also a few other charges that cardholders should be aware of. There is a foreign transaction fee of 2.95%, and if late with your payment, you can expect a £12 fee. That same fee is applied if the user goes over their limit.

How to Apply

In order to apply for this credit card, the potential applicant should be 18 or older, have a regular income, and be a resident of the UK. On top of these qualifications, they should also not have declared bankruptcy or have any pending collections or reparation agreements. It is also suggested that the individual has not applied for a credit card within the last month.

When applying, they will need to make sure they have the following information:

- Current, valid UK address, as well as previous addresses within the last three years

- Phone number & email address

- Annual income before taxes

- Current account number and sort code for main bank account

- Information on any other credit cards

Once the applicant has met those requirements and collected those documents and information, they should first use the eligibility checker. This will save some time and let them know if they have a chance of being approved. If it comes back eligible, the next step is to fill out the application. You can do this online, over the phone, or in a branch office.

Halfway through the application process, you will find out if you have been approved. This is based on many factors. Once the applicant has been approved, the card will be mailed to you and arrive within seven business days. The pin will be available within five days.

Contact Information

For more information, you may want to contact the bank. Here are a few ways to do that.

Main Branch

Lloyds Bank PLC, 25 Gresham Street, London, EC2V 7HN

[If you want to find a branch check here.]

Website: www.lloydsbank.com

Tel: 0345 602 1997 (UK), +44 1733 347 007 (internationally)

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.